Summary:

The

upstream supply of the amino acid market in China is normal, with an average

market purchasing and selling atmosphere, and downstream demand remains

rational and demand-driven. Lysine manufacturers' quotes are stable, with

average downstream inquiry and orders, and exports are strong; 98% lysine

hydrochloride manufacturers' quotes are steady, focusing mainly on export

orders; 70% lysine manufacturers' quotes are slightly weak, with some terminals

expecting a downward trend in the market, and demand is mainly for hard

necessities. Threonine is in short supply domestically, with high spot

transaction prices, and downstream users mostly maintain a demand-driven

procurement strategy. There is a strong expectation of a decline in the price

of methionine, which continues to be weak, with downstream demand remaining

sluggish and actual transactions scarce. Tryptophan market manufacturers'

quotes are slightly lower, with low downstream demand and slow restocking.

Valine manufacturers' quotes are weakly adjusted, with a light market

transaction volume.

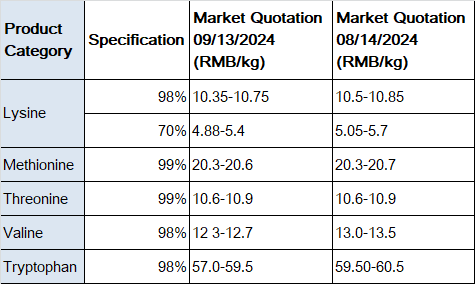

Price Trend

Data source: ChemNet

Lysine, Valine, Tryptophan: Currently, the

factory quotes for 98% lysine are temporarily stable, with the issuance of

export orders being dominant. There is a higher downstream inventory for 70%

lysine, and the market expects prices to fall, which results in low enthusiasm

for domestic purchasing and selling activities.

Threonine, Methionine: Recently, the

factory quotes have been maintained at a relatively high level. In the trade

market, most merchants do not choose to build inventory. Manufacturers have a

strong control over the supply of goods, which keeps the market supply

relatively stable. The production cost of threonine is relatively stable, and

the main raw materials for methionine production are energy chemical products

such as propylene, methanol, and natural gas, whose price fluctuations are

relatively small. It is expected that the prices of threonine and methionine

will continue to remain stable in the short term.

Market Status and Influencing Factors

The current market situation and

influencing factors for amino acids, particularly lysine, valine, and

tryptophan, are as follows:

1. Demand from the feed

industry is growing slowly.

Currently, the demand for 70% lysine is

relatively weak. Data from the China Feed Industry Association shows that in

the first half of 2024, the total national industrial feed production decreased

by 4.1% year-on-year. Slow growth in feed production implies limited growth in

demand for lysine. Downstream users are cautious about the market, purchasing

rationally, and mostly buying on demand without hoarding. The lack of robust

growth in downstream demand makes it difficult for lysine prices to rise.

2. Weakening cost support.

Lysine production primarily uses corn as a

raw material, and corn prices have been declining since the second half of

2024. As corn prices fall, cost support weakens. In August, the average

national corn price was 2286.78 RMB/ton, a decrease of 3.50% compared to July.

Source: China Feed Industry

Information Network.

Future Outlook and Challenges

1、Expansion of Export Scale: Entering

September, the production of lysine manufacturers is expected to remain normal,

and the market supply is anticipated to be very abundant. At the same time,

orders for the fourth quarter have already been signed overseas, and the

manufacturers' willingness to support prices begins to emerge, which will play

a strong supporting role for the domestic market in China. The promotion of corporate

internationalization strategies is also continuously expanding into overseas

markets. Companies will improve the international reputation and market share

of their products by participating in international exhibitions, carrying out

international certifications, and establishing overseas sales networks.

2、Growth in International Market Demand: The

global demand for amino acids continues to grow, especially in developing

countries, where economic development and the improvement of people's living standards

have led to an increasing demand for protein and nutritional health products,

thereby driving the growth in demand for amino acids. As a major global

producer of amino acids, China has cost and quality advantages and can meet the

needs of the international market.

In general, In September lysine

manufacturers' production is normal and the supply is sufficient. Overseas

fourth-quarter orders lead manufacturers to support prices, which helps the

domestic market. Globally, the demand for amino acids is growing, especially in

developing countries. As a major producer, China has cost and quality

advantages. With the improvement of living standards and the development of

pharmaceutical and food industries, the demand for high-value-added amino acid

products is rising. Technological innovation, like new fermentation processes

and optimizing strain selection to reduce costs and increase production, drives

the industry. Developing high-value-added products and continuous innovation is

an important trend for meeting market demand and enhancing competitiveness.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.